Gold mutual funds represent a useful choice for novice financiers. An Expert Guide Gold mutual funds offer a useful investment option for people who are brand-new to investing. These funds unite capital from many financiers to invest in various gold-related assets which offers you the opportunity to participate in the gold market without acquiring physical gold. Investors must understand gold's function within their investment strategy because it provides diversity and defense from financial instability. Investors need to assess both the prospective risks and benefits when thinking about gold mutual funds. Gold prices reveal considerable fluctuations and any investment in gold carries the inherent risk of uncertain returns. Before purchasing gold mutual funds you need to assess how well they match your financial objectives. Analyzing the performance history of particular funds provides valuable insights for investors. This understanding lets you figure out if gold mutual funds should become part of your financial technique. Maintain current knowledge about financial investments and seek advice from financial experts when needed.

Understanding Gold Mutual Funds

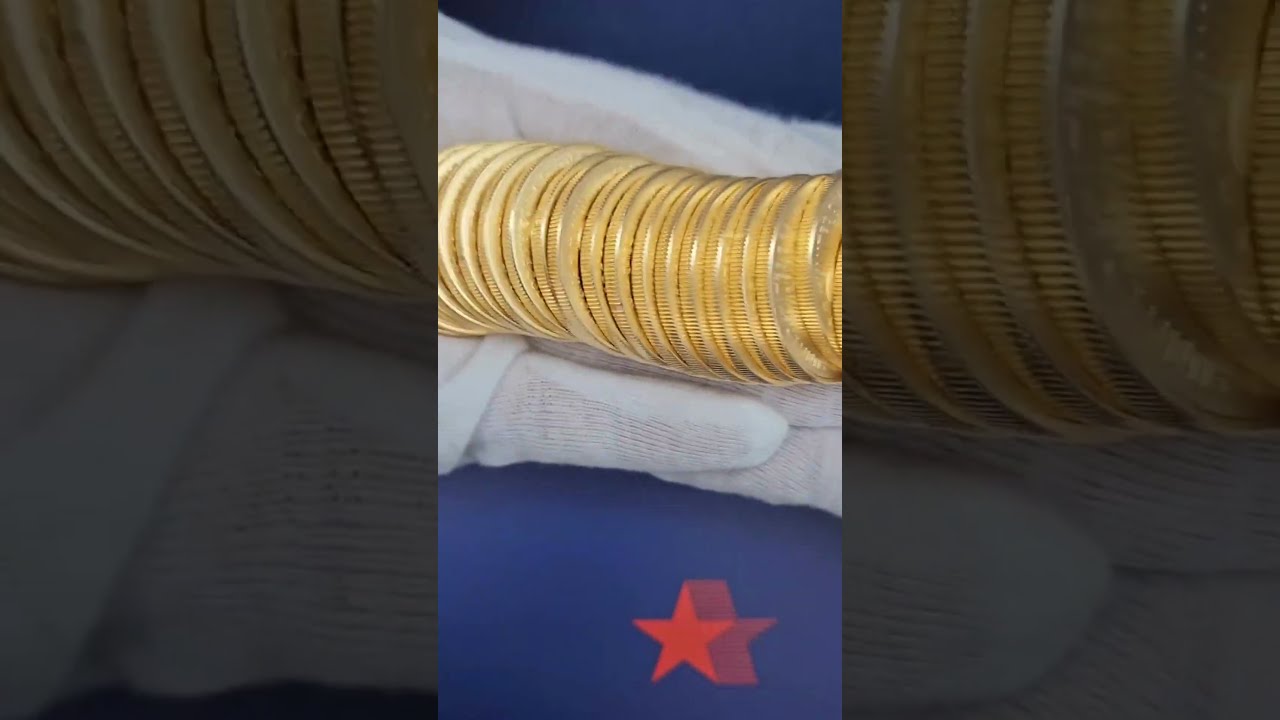

Financiers can access the gold market through gold mutual funds without purchasing physical gold. These funds allow investors to gain access to expert management services together with varied gold sector investments.Definition and Types

Gold mutual funds operate by integrating investments from various investors to acquire assets connected with gold. Investments through these shared funds might consist of gold mining stocks together with physical gold and other related gold property investments. You can stumble upon several types of gold mutual funds in the market. Gold Equity Funds: These funds purchase shares from corporations that extract gold or carry out gold-related service activities. Gold ETFs: Some mutual funds run like exchange-traded funds due to the fact that they track gold rates to make their financial investments. Gold Mining Funds: The focus of gold mining funds is on businesses that extract and produce gold. Selecting the proper fund type need to match your preferred threat level and degree of exposure. Gold equity funds show greater volatility since they count on company performance while funds that purchase physical gold strive to follow gold costs more directly.How Gold Mutual Funds Work

Purchasing a gold mutual fund permits you to acquire shares of a professionally managed portfolio. Experts who manage gold mutual funds make choices about gold property choice through market analysis. The mutual fund manager designates your investment across several gold-related properties. Your investment threat is dispersed because you hold several assets instead of one single investment. The ability to buy and offer show ease makes them suitable for a wide range of financiers. Investors need to pay management charges when they buy gold mutual funds. Understanding these costs is important because they have a direct effect on your investment returns. Review the fund's historic performance together with its threat profile before making a financial investment choice. Gold mutual funds allow you to match your investment with both your monetary targets and run the risk of capacity.Pros and Cons of Gold Mutual Funds

Gold mutual funds offer diversity and liquidity to financiers yet carry specific threats and costs. You ought to evaluate these components thoroughly to pick your financial investment choices sensibly.Diversification Benefits

Gold mutual funds permit you to widen your investment portfolio through diversity. Investing in these funds permits you to assign your money throughout several asset types. Gold has different cost movements compared to stocks or bonds which permits it to support your portfolio. Financiers may find gold costs increasing when stock exchange decline as this can help stabilize their investment losses. By purchasing gold mutual funds you can secure your investments from market volatility. Gold mutual funds include both physical gold and different gold-related assets. This diversity method decreases danger exposure while offering opportunities for better financial investment returns.Liquidity Considerations

Investors can access their cash faster through gold mutual funds than through physical gold properties. This feature enables financiers to access their invested cash quick when required. Gold mutual funds get rid of the requirement for physical storage and market sale of gold. Financiers can trade gold mutual funds with the same ease as they trade other shared funds. Their accessible nature draws the attention of numerous investors. The marketplace conditions will affect both the market price and the time frame for liquidating your shares. Timing might also affect your profits.

Risk Factors

Gold mutual funds bring investment threats just like any other investment choice. Gold cost modifications directly affect the value of these funds. Prices react to worldwide occasions along with modifications in currency worths and market patterns. Gold is regularly considered as a protected investment option however may not secure ensured monetary returns. Changes in prices can create opportunities for significant revenues and losses. Your investment result counts on the fund manager's choices and methods which may not totally match your financial objectives.Cost Analysis

There are costs connected with buying gold mutual funds. Purchasing gold mutual funds includes potential expenses consisting of management charges, administrative costs and sales charges. Understanding these fees is important since they impact your total financial investment returns. Funds frequently use costs throughout deals when shares are acquired or sold. The accumulation of these charges can decrease your financial investment revenues. Assess the expenditure ratio before committing to any shared fund you are thinking of buying. Reducing costs will help increase your overall returns in time.Evaluating Gold Mutual Funds for Beginners

Financiers can use gold mutual funds to gain direct exposure to gold without acquiring physical gold properties. You need to evaluate whether the fund pleases your investment objectives while finding out to determine its efficiency and identifying your investment duration.Suitability for Financial investment Profiles

Understanding your financial investment profile is vital. Do you prefer to reduce danger or are you comfy with higher levels of uncertainty? Gold mutual funds offer risk reduction through diversity since gold's habits stands out from the performance of stocks and bonds. These investment alternatives might be proper if balancing danger with potential returns is your goal. The evaluation of Risk Tolerance together with Monetary Objectives stays important for financiers. Assess your portfolio's gold allocation based upon your danger tolerance and time horizon for financial investment.

Performance Metrics

The history of gold mutual fund performance ought to be an important assessment factor. Historical Returns: What average returns have gold mutual funds provided throughout the previous 5 to ten years? This reveals understanding of past outcomes however does not forecast upcoming efficiency.Consider Expense Ratios too. Fees that fund supervisors charge get subtracted from the fund's overall assets. Reduced expenses help increase your total investment returns. Independent source rankings supply insight into how the fund compares to peer funds.

Investment Horizons

The duration you prepare to remain invested impacts your decision to markets.businessinsider.com purchase gold mutual funds. Think about your Short-term and Long-term objectives. Gold mutual funds reveal short-term volatility although they can provide stability throughout extended investment durations. High volatility presents prospective threats for those who need to invest for short-term objectives. A longer financial investment period enables the fund to stabilize market fluctuations and produce a safer financial investment environment. Make certain your investment timeline matches both your monetary goals and your tolerance for danger.Comparing Gold Mutual Funds to Other Investments

Investors can participate in gold markets through shared funds which eliminate the requirement to manage physical gold. Gold mutual funds stand unique from investment choices such as gold ETFs and real gold bars. An analysis of how these funds carry out relative to other property types such as stocks and bonds would be useful.Physical Gold vs. Gold Funds