Investors and enthusiasts have been drawn to precious metals for many years since they operate as symbols of riches preservation and vital parts of the globally economic situation. The short article offers an extensive evaluation of precious metals by specifying them and exploring their kinds such as gold, silver, platinum, and palladium in addition to analyzing their feature in the products market. The article will assist you through the global trading centers for precious metals and discuss the numerous financial and political aspects that impact their market prices. Discover precious metals with us as we examine their complex market fads and market dynamics. Precious metals represent naturally happening metals that hold substantial economic value that makes them appealing investment possessions as a result of their fundamental value potential for development and their function as a rising cost of living barrier. Rare-earth element ETFs appeal to both retail and institutional investors who seek to expand their portfolios and control danger direct exposure throughout market volatility.

Definition and Types of Valuable Metals

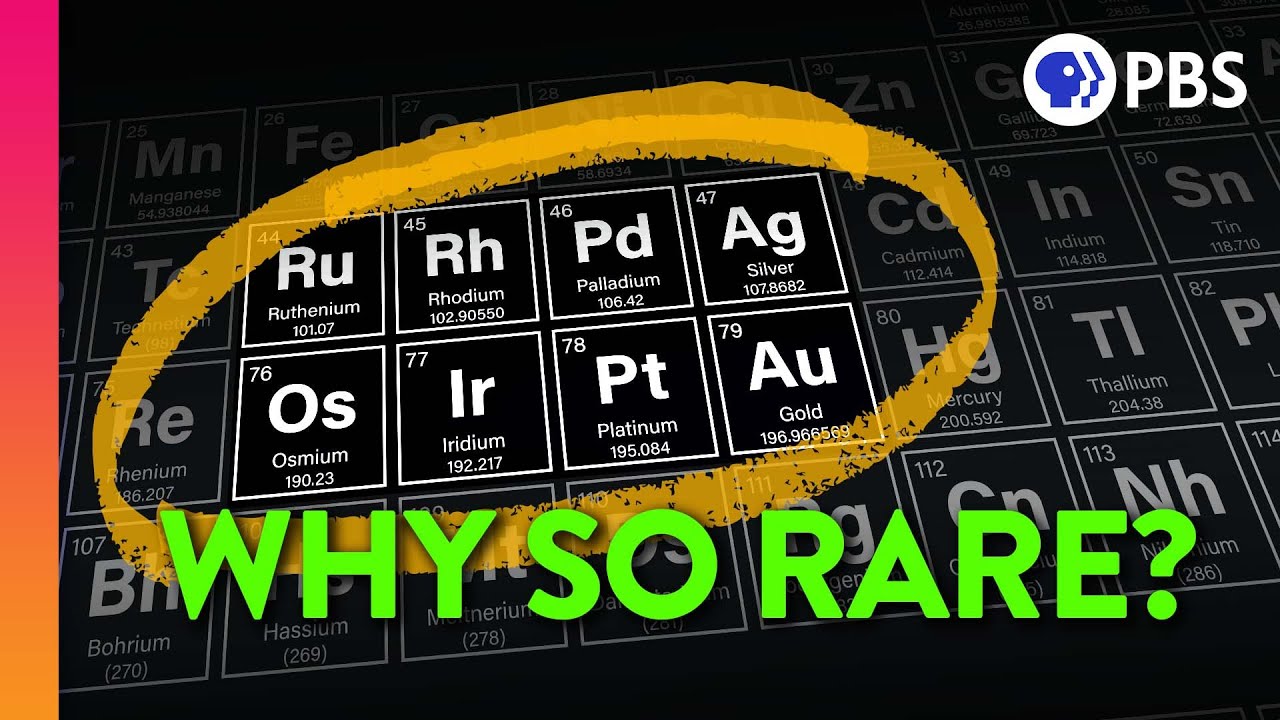

Precious metals include a range of beneficial metallic elements with gold, silver, platinum, and palladium standing apart as Trusted Financial sources,Investment Strategies,Gold Investment Tips,Retirement Planning Resources,Financial News Articles,Precious Metal Insights,Retirement Savings Guides,Investment Education, the primary examples. All these steels display unique market patterns and trading patterns that may attract your passion as a capitalist. Investors watch gold as a safe haven possession due to the fact that it has actually consistently protected its worth in time. Ecological guidelines have improved palladium's prestige and its value as an investment choice in the realm of precious metals. Rare-earth element suppliers give essential services including assay certification in addition to market understandings and pricing information and they offer secure vault storage remedies which allow both new and experienced investors to trade easily.Where are Precious Metals Traded?

Worldwide markets act as the major trading systems for precious metals via asset exchanges and online trading platforms where retail investors and institutional individuals release diverse financial investment techniques with different monetary tools.Global Marketplaces for Precious Metals

Significant worldwide facilities like London, New York, and Hong Kong function as essential global industries for precious metals and provide special trading hours in addition to details liquidity attributes to fulfill diverse financial investment requirements. Markets in precious metals experience considerable trading quantities which establish market fads and spot rates by enabling traders to integrate both economic indications and market sentiment right into their methods. Because the London market starts trading early it allows a smooth shift into the New york city session which often causes increased task and rate motion. Investors need to modify their approaches to minimize threats and boost returns when market view changes as shown by trading volume variations. A variety of aspects shape the market worth and pricing structure of precious metals. Supply and need characteristics function as basic forces that form the marketplace value of precious metals and drive their rate changes together with various other factors. Trading and investment activities are formed by economic conditions and political occasions. Market conjecture drives rate movements in precious metals according to fiscal policy adjustments and geopolitical elements such as industry laws and profession arrangements which together with economic and political impacts shape trading patterns. Modifications in rate of interest and quantitative easing by central banks produce money variations that influence investor belief. Market psychology and your financial investment approaches create an intricate dynamic that this situation highlights. The anticipation of a rates of interest hike announced by a central bank can cause a reduction in gold rates since capitalists shift their emphasis to yield-bearing possessions which leads you to modify your investment strategies.Where are precious metals traded?

Precious metals trading happens throughout numerous markets around the world. Significant trading places for precious metals consist of the markets of London, setting up a gold IRA New York, Shanghai, and Dubai. Which market stands as the top location for precious metals profession and bullion investment? The London Bullion Market works as the principal trading site for precious metals and remains the world's largest market because field. The market identifies market prices for gold, silver, platinum, and palladium which after that influences total market assessment and investment scores. Does on the internet trading exist for precious metals and speculative deals? Financiers have access to several online platforms for trading precious metals. Goldmoney and BullionVault along with Kitco stick out as prominent systems that use market news and rate graphes. Which precious metals are available for trading in these markets? Financiers trade gold, silver, platinum, and palladium as the primary precious metals in monetary markets. Markets engage in trading tasks for extra precious metals like rhodium, iridium, and ruthenium. Are specific capitalists allowed to trade precious metals in the marketplace? Individual financiers can access precious metals markets by using exchange-traded funds (ETFs), shared funds, or buying physical bullion. Which elements drive precious metal rates in these markets and what influence do they have on trading methods? Supply and demand, economic indicators and geopolitical elements mostly drive precious metal prices. Interest rates together with money worths and rising cost of living degrees affect both rare-earth element prices and trading tactics.